1、System Overview

Smart finance is to rely on Internet technology,use big data,artificial intelligence,cloud computing and other financial technology means,so that the financial industry in business processes,business development,customer service and other aspects of comprehensive wisdom,to achieve intelligent financial products,risk control,customer acquisition,services.A new one-stop,self-service,and intelligent service experience that includes bank branches,mobile banking apps,WeChat services,and more.The business processing mode has shifted from"teller operation as the main focus"to"customer autonomy and self-service processing".

Third party platforms are integrated with many traditional financial institutions in the industry,such as banks,insurance companies,funds,and trusts,to conduct detailed analysis of user behavior,markets,products,etc.,and intelligently recommend diversified investment portfolios to customers.The platform establishes a risk control system driven by data and technology as its core.Establish comprehensive risk control capabilities that include user data collection,real-time computing engine,data mining platform,automatic decision engine,and manual assisted approval.

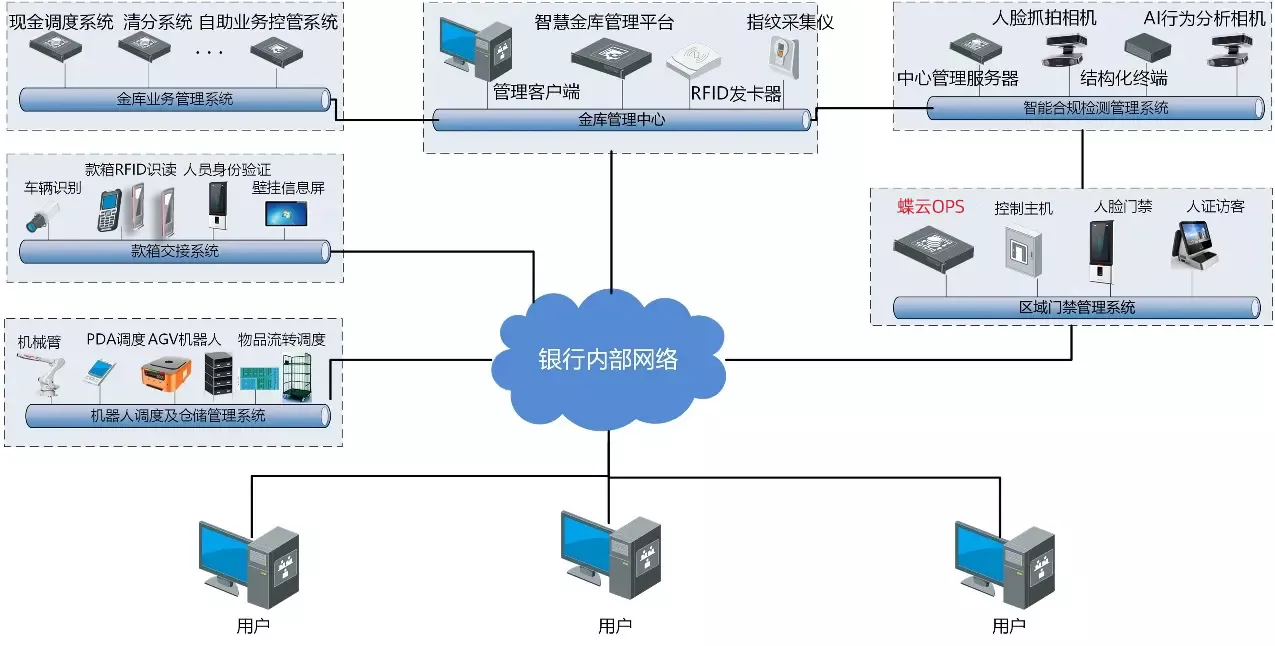

2、System Block Diagram

3、Application of the system

Smart finance is a more advanced stage of the evolution of traditional financial services in the Internet era.Under the smart financial system,users can apply financial services more conveniently,and they are no longer willing to wait in line for hours at bank branches just to save money or take out loans.

Under the smart financial system,users can apply financial services more conveniently.After obtaining sufficient information,financial institutions can respond in real time through big data engine statistical analysis and decision-making,providing targeted services to meet users'needs.In addition,the open platform integrates various financial institutions and intermediaries,providing users with a rich and diverse range of financial services that are both diverse and personalized.These financial services are packaged as one-stop services,and users can also make personalized choices and combinations according to their needs.

Financial institutions rely on big data credit reporting to compensate for the imperfect credit reporting system in China when providing services to users.When conducting risk control,there are more dimensions of data,more accurate decision-making engines,and better anti fraud results.On the other hand,Internet technology has improved the protection of user information and capital security.